20+ 2021 401k calculator

This limit includes both the workers and the employers contributions combined. Backward since 401k contribution limits were lower in the past.

Early Retirement Calculator Spreadsheets Budgets Are Sexy

Any way to include an option to calculate max 401k contribution returns.

. The 401k Calculator can estimate a 401k balance at retirement as well as distributions in retirement based on income contribution percentage age salary increase and investment return. Such as healthcare 401k or other financial costs and taxes are not taken from your take home pay. The Long View 2021 Business Vision.

If your employer does not offer 401k loans they may still offer a 401k withdrawal. Retirement plan income calculator. Calculate your total tax due using the tax calculator updated to include the 202223 tax brackets.

Understanding Self-Employment Tax. In 2022 100 of net adjusted business profits income up to the maximum of 20500 and 27000 if age 50 or older can be contributed in salary deferrals into a Solo 401k 2021 limits are 19500 and 26000 if age 50 or older. Enter your IRA contributions for 2021.

202223 Tax Refund Calculator. Amount that you plan to add to the principal every month or a negative number for the amount that you plan to. Having extra money in your pocket is just a.

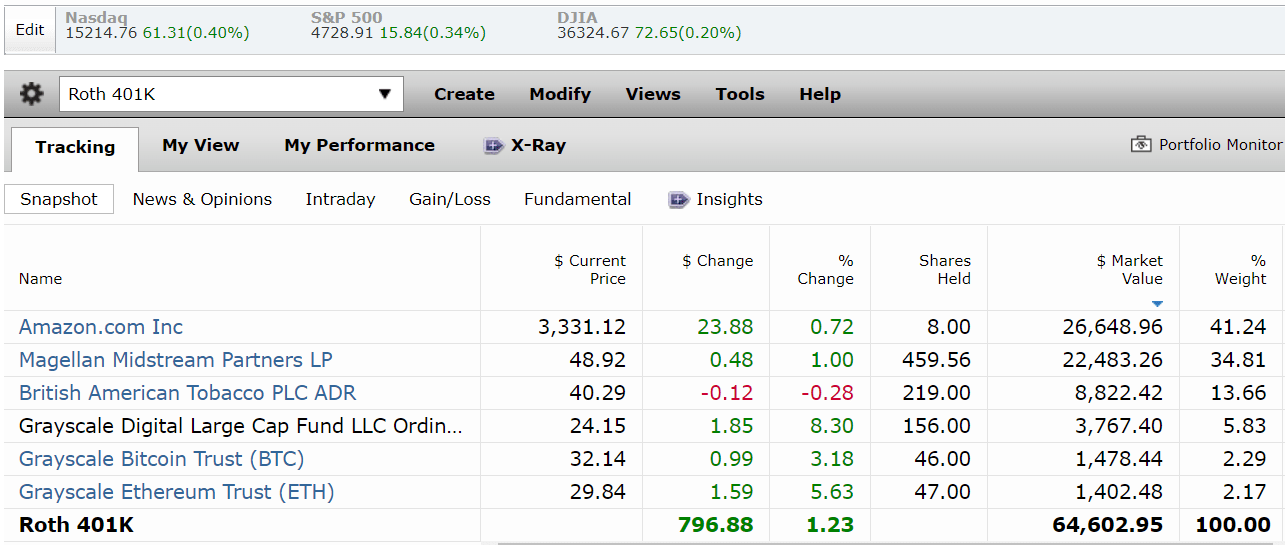

401k IRA Health savings account deduction. Stocks are close to 20 of the portfolio and bonds make up about 80 so the market risk is higher than with a bond fund but. October 10 2021 at 320 pm Very useful.

You may prefer to use the State Tax calculator which is updated to include the State tax tables and rates for 202223 tax year. This applies even though you didnt actually receive the 20 withheld. Enter your IRA contributions for 2021.

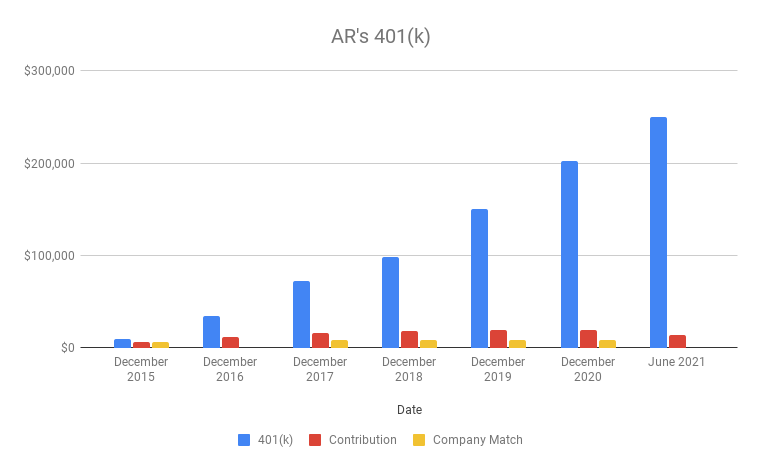

Ive maxed my 401k and want to compare it against different indices to see if my investments are underperforming. In this case your net earnings from self-employment is defined as your businesss profit minus the deduction for one half of. Reviewed by JeFreda R.

He deferred 19500 in regular elective deferrals plus 6500 in catch-up. For instance in 2022 the 401k contribution limits rose 1000 from 2021 You start full-time employment at age 22 at a company that provides a 401k without a company match. For example tax-advantaged accounts like a 401k traditional IRA solo.

Employers that fund 401k plans often match a portion of the savings made by their workers. Total contributions to a participants account not counting catch-up contributions for those age 50 and over cannot exceed 61000 for 2022 57000 for 2020. Roth 401K vs 401K Traditional IRA.

2022 Immediate Annuity Rates Immediate Annuity Income Quote Calculator Whats an Immediate Annuity SPIA DIA QLAC. Ben age 51 earned 50000 in W-2 wages from his S Corporation in 2020. Calculations are based on the average annual CPI data in the US.

However the maximum that can be contributed toward your total tax-deferred retirement accounts in 2021 is 58000. Amount of money that you have available to invest initially. Tax Refund Schedule Dates 2021 2022.

Year In Review 2021 Market Summary. Taxes withheld are reported on 1099-R Box 4. As an investor-owner you own the funds that own Vanguard.

If you received a distribution check from your 401K 20 in federal taxes might have been withheld from that check. 15 percent or 20 percent in the 2021 or 2022 tax year. Victor I just finished updating the Historical Investment Calculator with end-of-year data for.

Cashing out of your 401k is an incredibly risky choice that should only be made under extreme circumstances. From 1914 to 2021. When you are shopping for immediate annuity rates or immediate annuity quotes it is good to understand that this is the most fundamental pure form of an annuitySingle Premium Immediate Annuities acronym SPIA date back a couple of.

An employer contribution of 20 of your net earnings from self-employment and. Loan type select box you can choose between HELOCs and home equity loans of a 5 10 15 20 or 30 year duration. They can do this up to the limit which is the lesser of 100 of a workers pay or 58000 for 2021 or 61000 for 2022.

Interest Payment Retirement Amortization Investment Currency Inflation Finance Mortgage Payoff Income Tax Compound Interest Salary 401K Interest Rate Sales Tax More. Free inflation calculator that runs on US. For 2021 you can contribute up to 19500 up to 26000 if youre age 50 or older.

Solutions in Focus 2022. Enter your total 401k retirement contributions for 2021. The tax year 2022 will starts on Oct 01 2021 and ends on Sep 30 2022.

For the 10-year period ended December 31 2021 7 of 7 Vanguard money market funds 67 of 86 Vanguard bond funds 21 of 24 Vanguard balanced funds and 128 of 183 Vanguard stock fundsfor a total of 223 of 300 Vanguard fundsoutperformed their Lipper peer group averages. For people under the age of 59½ a hardship withdrawal or early withdrawal from your 401k is allowed under special circumstances which are on the IRS Hardship Distributions pageUsing your 410k for a down payment on a principal residence is. The state tax year is also 12 months but it differs from state to state.

Compound Interest Calculator Best Savings Accounts Best CD Rates Best Banks for Checking Accounts Best Personal Loans Best Car Loans. Moving expenses for a job. The 2021 deferral limit for 401k plans was 19500 the 2022 limit is.

Enter your total 401k retirement contributions for 2021. The numbers are more forward-looking vs. You must roll over the check amount and the 20 within 60 days for the distribution to be tax-free.

Social Security Benefits Estimator. Try the H. A catch-up contribution of for if you are 50 or older.

2022 Self-Employed Tax Calculator for 2023. For 2021 you can contribute up to 19500 up to 26000 if youre age 50 or older. The New HR Block Tax Calculator.

Remember your 2021 maximum Roth IRA contribution is 6000 and the pre-tax contribution limit for traditional 401ks stands at 19500 for 2021. The first is the 20 penalty you will pay to the IRS which is taken directly to cover the tax you would pay on. Profit Sharing Contribution A profit sharing contribution can be made up to 20 of net adjusted businesses profits.

CPI data or a custom inflation rate.

:max_bytes(150000):strip_icc()/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age

20 Free Retirement Calculators My Annuity Store Inc

The Realistic Investment And Retirement Calculator

The Realistic Investment And Retirement Calculator

20 Free Retirement Calculators My Annuity Store Inc

Using Roth Retirement Accounts To Avoid Taxes In Retirement Seeking Alpha

Why You Should Max Out Your 401 K In Your 30s

How To Build Wealth Fast This Chart Shows What It Takes

The Realistic Investment And Retirement Calculator

Early Retirement Calculator Spreadsheets Budgets Are Sexy

20 Free Retirement Calculators My Annuity Store Inc

20 Free Retirement Calculators My Annuity Store Inc

Retirement How To Save A Million And Live Off Dividends Seeking Alpha

3 Blue Chip Bargains I Just Bought For My 401 K And So Should You Seeking Alpha

20 Free Retirement Calculators My Annuity Store Inc

20 Free Retirement Calculators My Annuity Store Inc

The Realistic Investment And Retirement Calculator